“Mastering Credit Building: Enhancing Your Score with Rent Reporting Services”

Upgrading your credit score is no easy task. Many people are often clueless about where to start when it comes to repairing or building their credit history. Luckily, we’ve discovered a unique way you can work on boosting your credit score simply by paying your rent! Yes, that’s right. With the existence of rent reporting services, your rent payment can become an instrument for improving your credit history.

Now, let’s take a deep dive into how these services function and how you can leverage them to your advantage.

To begin comprehending what rent reporting services are, let’s go back to the basics. Usually, when individuals talk about credit history, most minds immediately think about credit cards or loans. However, on-time payments on these are not the only elements that can boost your credit score.

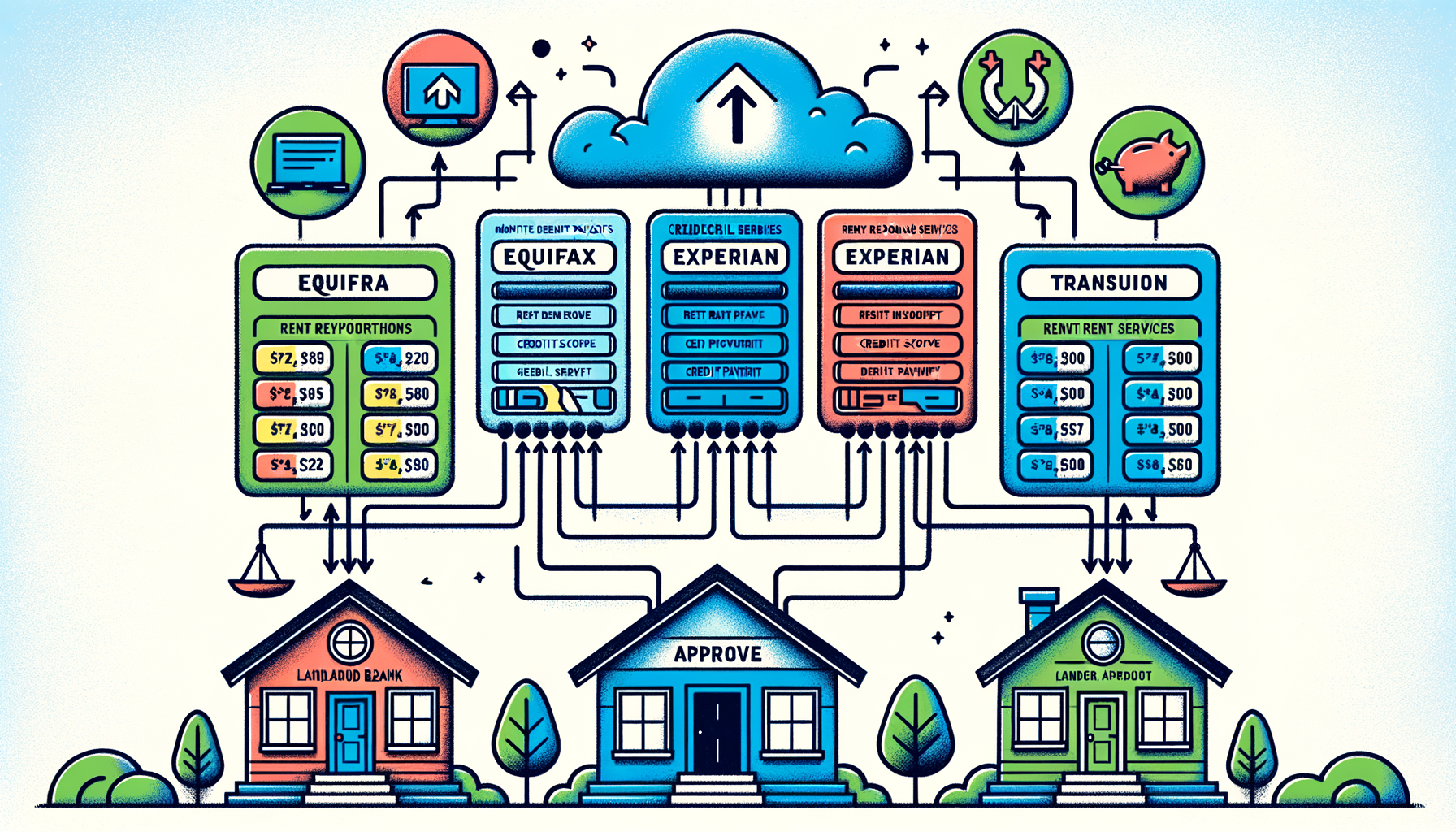

Cue in rent reporting services. These are platforms that can assist you in recording your prompt rent payments on your credit report. Basically, when you pay your rent on time, these services can ensure that the credit bureaus are aware. This, in turn, can help you augment your credit score. In essence, these services can convert an ordinary activity like paying rent into an effective method for credit repair or growth.

You must be thinking, how does this process pan out? Well, after you sign up for a rent reporting service, every month your payment of rent gets recorded on your credit report. The reporting services can either pull this information directly from your landlord or have you upload proof of payment. Several rent reporting services extend direct integration with your bank, thereby simplifying the process even further.

Understandably, the question arises: Why is it vital to report your rent payments? Generally, consistent, on-time payments positively impact your credit score, which is potent in many ways. A good credit score can aid you in saving a substantial amount of money over time as it can garner better interest rates on loans or credit cards. It can also enhance your chances of getting approved for a new credit line. Furthermore, landlords, utility companies, and even certain employers check out credit scores to evaluate reliability. Hence, a solid credit score is advantageous both for your pocket and reputation.

Having demystified rent reporting services and their paramount importance, your curiosity about which platforms to consider might have piqued. There are a few respectable rent reporting services available today. Some of the well-known ones include PayYourRent, RentalKharma, ClearNow, and RentTrack. However, not every service might align perfectly with your specific needs. It is suggested to carry out thorough research and review each platform comprehensively before signing up. Learn about their pricing, process, and customer service to find the service most convenient and economical for you.

While considering a service, do give meticulous attention to pricing and subscription models. The costs for these services vary per platform. Some have monthly fees, while others might charge a setup fee. In certain situations, you could get charged per transaction. Hence, it is essential to understand all charges involved so that you can factor them into your budget accurately.

Another pivotal pointer is to make sure the services report to all three major credit bureaus: Equifax, Experian, and TransUnion. This is because not every lender checks every bureau, hence for the maximum positive impact on your credit score, it’s critical that your rent payments are reported to all three.

Are there any obstacles to utilizing a rent reporting service? Apart from the associated costs, it’s significant to recall that not every landlord may agree to this service. Some may not want to take out additional time or deal with another third party. However, there are platforms that let you submit the payment receipt directly. This way, you sidestep the need for your landlords to be directly involved, bypassing this potential roadblock.

Often, a concern is whether these services would help all types of consumers. Most people with a younger or sparse credit history benefit significantly from these services. Also, individuals who struggle with credit or wish to build it from scratch should consider rent reporting services. On the other hand, if you already boast an extensive, healthy credit history, adding rent payments might not drastically move your score.

It’s noteworthy that rent reporting services may not always carry a positive impact. Late rent payments reported can damage your credit score. Hence, this tool should be used responsibly, and it’s crucial to ensure that you can comfortably afford your rent before signing up for such services.

So, how quick are the results? The time it takes for your rent payments to reflect on your credit report, and then for your score to alter, can vary. Each platform is different, and also, so are the credit bureaus. Hence, patience would be the key. However, it is generally observed that a positive shift in the credit score is seen after two to three months of consistent, on-time rent payments being reported.

In summary, rent reporting services can be a handy tool in your credit-building or credit-repairing journey. Paying rent is already a necessity for most people, so why not make it work to enhance your credit score too? While it’s a fantastic tool, it is equally essential to be aware of the potential costs and understand that it is no magic wand for overnight improvements. Like anything worth having, building a good credit score takes time, healthy habits, and responsible spending.

However, when used wisely, rent reporting services can be a convenient pathway toward improving your financial status and achieving long-term financial goals. In our world today, building a good credit score remains an important objective for many, and this innovative way of making your regular rent payments count towards this goal could possibly be a game changer!

So, are you ready to take control of your credit score with rent reporting services? Begin today, and remember, every rent payment counts!