Category Archives for "Mortgage Industry News"

The recent trend in mortgage rates has seen relatively steady levels over the past several weeks, compared to fluctuations in earlier periods. The term “4 week highs” might sound alarming, but it merely mirrors the current reality. However, it’s important to note that the modest dips observed today still happen within a narrow scale, with minor variations from day to day. This suggests that the average mortgage holder might not notice any significant changes to their rates from the previous week.

The potential for change, however, becomes more prominent tomorrow. This is due to major scheduled occurrences that could prompt larger shifts in either direction. The main event of focus is the announcement of the Consumer Price Index (CPI) for December, which is a critical gauge of inflation and a consistent predictor of market movement. Experts and investors dedicate considerable effort to reaching a consensus on the expected figures from the report. As a result, it’s quite a challenge to anticipate if the upcoming data will favor or disadvantage rates without the ability to forecast the future with certitude.

Moreover, it’s worth mentioning that even though this report can trigger substantial shifts in rates, it doesn’t necessarily mean it will. The magnitude of the impact is usually related to how much the actual figures deviate from the predicted consensus. For instance, the most important figure—the Core month over month CPI—is forecasted to report a 0.3% rise. Should the actual figure be 0.1%, this significant discrepancy would likely cause a substantial decrease in rates. On the other hand, a figure of 0.5% could cause an accelerated increase in rates.

Continue reading

The previous week concluded with significant data releases including the jobs report and ISM, creating anticipation for the upcoming CPI set to be released at 8:30 am ET this week. Since then, the rate trend has been showing a gradual, sideways narrowing pattern.

The only potential disruption that might disrupt the calm comes from the Treasury auction cycle. Since the final auction is scheduled to occur post the CPI announcement, and the first auction has already been concluded, the 10-year auction slated for today remains the only significant event before the unveiling of this week’s most anticipated news.

Continue reading

I’ve been feeling exasperated by the premature focus of mainstream media on the 2024 elections, which are still quite some time away. It’s disheartening to note the scarcity of younger candidates for presidency in a country whose average citizen is around 38 years old. Our options should be devoid of party affiliations, just as it happened in France where Gabriel Attal was named prime minister at a mere 34 years old. As an interesting side note, France’s inflation rate currently stands at 3.7%, highlighting the connection between inflation, central banking activities and the Consumer Financial Protection Bureau (CFPB) – the mention of which immediately puts my cat, Myrtle, aloof off boredom! A recent announcement indicated that CFPB’s annual adjustments for inflation in civil penalties were done in accordance with the Federal Civil Penalties Inflation Adjustment Act, and would take effect starting January 15, 2024. Looking ahead, we’ll be reviewing the Consumer Price Index to assess price fluctuations tomorrow. In other news, Truework has emerged as a key sponsor for this week’s podcast, aiming to help lenders avoid interruptions, enhance borrower experiences and mitigate the financial risk associated with income verification. From a more business-focused angle, the past couple of years have seen Jonathan Spinetto, the COO & Co-founder of Nyfty Door, lead his firm from having no loan origination to projecting a whopping 3000 loans a month by 2024, thanks to his collaboration with TRUV. Boosting conversion rates by over 60% and enabling savings of 60-80%, the partnership with TRUV has been largely beneficial, particularly in the areas of employment, income, insurance and asset verifications.

Continue reading

The week ending on January 5 experienced a substantial surge in mortgage activities, although it initially began from a lower threshold. The number of loan applications were compensated for the New Year’s holiday that started the week and compared to the Christmas Week’s four days. The Market Composite Index from the Mortgage Bankers Association (MBA) – a gauge of mortgage loan application volume – escalated 9.9 percent, seasonally adjusted, relative to the last week. It even exhibited a 45 percent escalation when left unadjusted.

The Refinance Index, adjusted for the holiday, saw a 19 percent hike from the preceding week and a 53 percent increase on an unadjusted level. Both versions reflected a 30 percent and 17 percent year-over-year increment respectively. The total applications saw a rise in refinancing, which constituted 38.3 percent compared to 36.3 percent a week ago.

Regarding the Purchase Index, the seasonally adjusted number rose by 6 percent over the week and correspondingly, went up by 40 percent on an unadjusted level. Nonetheless, the activity still trailed by 16 percent relative to the corresponding week in 2023.

Joel Kan, MBA’s Vice President and Deputy Chief Economist, noted an increase in applications, despite a hike in mortgage rates to commence 2024, following the holiday adjustment. The rise in purchase and refinance loan applications, encompassing conventional and government loans, marks a bright beginning of the year but it’s likely linked to the rebound in activities after the holiday break and year-end dips in rates. However, the volatility in mortgage rates and applications continues with the overall activity remaining low.

Continue reading

Mortgage rates experienced a slight increase for the second consecutive week recently. Despite this, they remain within a boundary that is seemingly favorable to consumers.

Continue reading

Trading on Friday saw a broader range and higher yields compared to the past few weeks. However, since then, the market has moved into a progressively narrower, sideways trend. Yesterday’s trading ranged well within Friday’s, and today’s range is even narrower than yesterday’s. What might this suggest? This progressively sharper but lateral trend can be inferred as market “indecision”, an understandable outlook with the Consumer Price Index (CPI) of December set to release on Thursday. While this week’s Treasury auction cycle presented an opportunity for heightened volatility, it left the market mostly unperturbed, particularly evident after today’s three-year auction.

Economic Data/Events

NFIB Business Optimism came in at 91.9, beating a forecast of 90.7 and a previous score of 90.6. IBD Economic Optimism stood at 44.7, compared to a previous 40.

Market Movement Recap

Trading at 10:23 AM saw a slight weakness overnight, but buyers gained an upper hand early in the day. The 10-year yield dropped by 2.5bps to 4.004, while the Mortgage-Backed Security (MBS) increased by 1 tick (0.03).

At 1:25 PM, there was no considerable shift after the three-year Treasury auction, which was reasonably strong. The 10-year yield dropped by 1.4bps on the day, closing at 4.015, and MBS retreated 2 ticks (.06).

Even at the closing time of 04:08 PM, the market remained largely unchanged as MBS slipped 1 tick (.03), and the 10-year yield declined by 1bp to 4.019.

Continue reading

The current average rate for a 30-year fixed mortgage, although more than 1% below the peak levels noticed in October, has been observing a gradual and consistent increase since the beginning of the year. Today’s rate mirrors the highest it’s been in the past four weeks. Though this might seem alarming, the perspective softens considering the rates are barely 0.2% above the December lows and the dip from the October peak scaled more than 1.4%. Any changes in today’s mortgage rates are attributed to the market fluctuations from the past two days and the routine settlement process for mortgage-backed securities (MBS), which influence daily mortgage rate changes. Presently, bond traders have their sights set on the upcoming inflation data from the consumer price index (CPI) on Thursday morning, presumed to be a major catalyst for rate oscillations.

Continue reading

After a rather monotonous overnight trading, the markets began with levels virtually unchanged due to the absence of Consumer Price Index (CPI) figures. The lack of December’s CPI data, scheduled for release on Thursday morning, is a common theme for the initial three days of this week. The only possible disturbance this week could be the start of the Treasury coupon auction cycle, commencing today at 1pm ET with three-year notes. Although not the most influential event in terms of market movement, it has triggered responses in the past. Currently, bonds are in a consolidation phase, following a correction from the low yields experienced at December’s close.

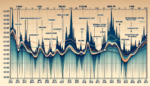

Overall, there’s a necessity to remain wary of the potential that the correction period is just commencing. The accompanying chart illustrates the recent consolidation process (highlighted by yellow lines). Either way, a significant deviation in the CPI could either validate or nullify the current red line trend.

Continue reading

As the new week began, bonds started at static levels, experienced a significant increase within the constraints of Friday’s figures before a steady, gradual sell-off. This resulted in a slight improvement by the end of the day. Analysts grappled with the uncertainty of what is driving these price movements, given that no major market motivators were reported in the news or appeared on the economic calendar. An NY Fed survey indicating muted inflation corroborated the morning increases; however, the timing was incongruous. Similar irregularities were noticed with various Fed comments throughout the day. The main takeaway of the day was an impression that it was focused mainly on establishing new positions for 2024 and in the more immediate timeframe, preparing for the forthcoming week’s Treasury auctions and CPI data.

Market Progress Summary

At 09:44 AM in a tranquil trading environment, there was no change to slight strengthening overnight. The 10yr was down by 2.8bps at 4.023, and MBS increased by 2 ticks.

Further gains were recorded at 11:58 AM. The 10yr decreased by 7.3bps at 3.978, and MBS increased by a quarter point.

However, by 04:58 PM, the mid-day gains were lost as trading moved into after hours. At this time, the 10yr decreased only 2bps at 4.03, and MBS increased just 1 tick (0.03).

Continue reading

The previous week observed various pivotal economic occurrences attempting to sway interest rate trends, although no evident victory was noted. Rates closed the week marginally elevated, with most of the rise seen at the start of the week. The pattern of bidirectional volatility persisting without significant alterations keeps its pace as the fresh week commences. Differing from the past Friday, there were no substantial, planned happenings that noticeably impacted the rate trends. Rather, the bond market initiated preparations for the events to unfold in the upcoming days. The Consumer Price Index (CPI) scheduled for this Thursday could be the most significant event of the week. As the most frequently traded inflation report, the CPI has been associated with some of the most drastic interest rate fluctuations in the last 2 years. However, such responses necessitate a result deviating significantly from the economy forecasters’ consensus. In simpler terms, the CPI has the POSSIBILITY of triggering a considerable reaction, but it is contingent on the report’s outcome. In the interim, the U.S. Treasury auction cycle is set to serve as a prelude. Over the coming 3 days, a vast quantity of Treasuries is set to go under the hammer (with results announced shortly past 1pm ET). If the demand is robust, rates could lean towards the lower end of their recent range preceding the CPI and contrary if otherwise.

Continue reading