Category Archives for "Mortgage Industry News"

Mortgage rates experienced a slight increase for the second consecutive week recently. Despite this, they remain within a boundary that is seemingly favorable to consumers.

Continue reading

Trading on Friday saw a broader range and higher yields compared to the past few weeks. However, since then, the market has moved into a progressively narrower, sideways trend. Yesterday’s trading ranged well within Friday’s, and today’s range is even narrower than yesterday’s. What might this suggest? This progressively sharper but lateral trend can be inferred as market “indecision”, an understandable outlook with the Consumer Price Index (CPI) of December set to release on Thursday. While this week’s Treasury auction cycle presented an opportunity for heightened volatility, it left the market mostly unperturbed, particularly evident after today’s three-year auction.

Economic Data/Events

NFIB Business Optimism came in at 91.9, beating a forecast of 90.7 and a previous score of 90.6. IBD Economic Optimism stood at 44.7, compared to a previous 40.

Market Movement Recap

Trading at 10:23 AM saw a slight weakness overnight, but buyers gained an upper hand early in the day. The 10-year yield dropped by 2.5bps to 4.004, while the Mortgage-Backed Security (MBS) increased by 1 tick (0.03).

At 1:25 PM, there was no considerable shift after the three-year Treasury auction, which was reasonably strong. The 10-year yield dropped by 1.4bps on the day, closing at 4.015, and MBS retreated 2 ticks (.06).

Even at the closing time of 04:08 PM, the market remained largely unchanged as MBS slipped 1 tick (.03), and the 10-year yield declined by 1bp to 4.019.

Continue reading

The current average rate for a 30-year fixed mortgage, although more than 1% below the peak levels noticed in October, has been observing a gradual and consistent increase since the beginning of the year. Today’s rate mirrors the highest it’s been in the past four weeks. Though this might seem alarming, the perspective softens considering the rates are barely 0.2% above the December lows and the dip from the October peak scaled more than 1.4%. Any changes in today’s mortgage rates are attributed to the market fluctuations from the past two days and the routine settlement process for mortgage-backed securities (MBS), which influence daily mortgage rate changes. Presently, bond traders have their sights set on the upcoming inflation data from the consumer price index (CPI) on Thursday morning, presumed to be a major catalyst for rate oscillations.

Continue reading

After a rather monotonous overnight trading, the markets began with levels virtually unchanged due to the absence of Consumer Price Index (CPI) figures. The lack of December’s CPI data, scheduled for release on Thursday morning, is a common theme for the initial three days of this week. The only possible disturbance this week could be the start of the Treasury coupon auction cycle, commencing today at 1pm ET with three-year notes. Although not the most influential event in terms of market movement, it has triggered responses in the past. Currently, bonds are in a consolidation phase, following a correction from the low yields experienced at December’s close.

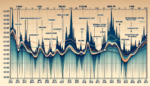

Overall, there’s a necessity to remain wary of the potential that the correction period is just commencing. The accompanying chart illustrates the recent consolidation process (highlighted by yellow lines). Either way, a significant deviation in the CPI could either validate or nullify the current red line trend.

Continue reading

As the new week began, bonds started at static levels, experienced a significant increase within the constraints of Friday’s figures before a steady, gradual sell-off. This resulted in a slight improvement by the end of the day. Analysts grappled with the uncertainty of what is driving these price movements, given that no major market motivators were reported in the news or appeared on the economic calendar. An NY Fed survey indicating muted inflation corroborated the morning increases; however, the timing was incongruous. Similar irregularities were noticed with various Fed comments throughout the day. The main takeaway of the day was an impression that it was focused mainly on establishing new positions for 2024 and in the more immediate timeframe, preparing for the forthcoming week’s Treasury auctions and CPI data.

Market Progress Summary

At 09:44 AM in a tranquil trading environment, there was no change to slight strengthening overnight. The 10yr was down by 2.8bps at 4.023, and MBS increased by 2 ticks.

Further gains were recorded at 11:58 AM. The 10yr decreased by 7.3bps at 3.978, and MBS increased by a quarter point.

However, by 04:58 PM, the mid-day gains were lost as trading moved into after hours. At this time, the 10yr decreased only 2bps at 4.03, and MBS increased just 1 tick (0.03).

Continue reading

The previous week observed various pivotal economic occurrences attempting to sway interest rate trends, although no evident victory was noted. Rates closed the week marginally elevated, with most of the rise seen at the start of the week. The pattern of bidirectional volatility persisting without significant alterations keeps its pace as the fresh week commences. Differing from the past Friday, there were no substantial, planned happenings that noticeably impacted the rate trends. Rather, the bond market initiated preparations for the events to unfold in the upcoming days. The Consumer Price Index (CPI) scheduled for this Thursday could be the most significant event of the week. As the most frequently traded inflation report, the CPI has been associated with some of the most drastic interest rate fluctuations in the last 2 years. However, such responses necessitate a result deviating significantly from the economy forecasters’ consensus. In simpler terms, the CPI has the POSSIBILITY of triggering a considerable reaction, but it is contingent on the report’s outcome. In the interim, the U.S. Treasury auction cycle is set to serve as a prelude. Over the coming 3 days, a vast quantity of Treasuries is set to go under the hammer (with results announced shortly past 1pm ET). If the demand is robust, rates could lean towards the lower end of their recent range preceding the CPI and contrary if otherwise.

Continue reading

This year, the spring real estate market might be kicking off slightly ahead of schedule.

Continue reading

Chief Production Officer, Jon Irvine, shares about the strategic approach the company intends to take in the upcoming five years. The plan comes in light of rising interest rates, escalating affordability issues, and other large-scale economic challenges they predict.

Continue reading

With nearly 39 million inhabitants, California hosts about an eighth of the entire U.S. population, a number exceeding that of Canada. It’s notable that a considerable percentage of Californians are from ethnic minority groups, and one in every four was not originally born in the U.S. Particularly in Northern California, many are involved in real estate and lending industries, making Federal Reserve forecasts a keen interest.

Primary dealer banks have now shifted their projections for the Federal Reserve to conclude its quantitative easing to the fourth quarter, a trend noted in a New York Federal Reserve Bank survey. If this happens as predicted, the Fed’s portfolio will decrease from the existing $7.764 trillion to $6.75 trillion. This could occur through maturing securities, early repayment of mortgage loans, or by the Fed liquidating those securities. The market has anticipated this change, a highly favourable development.

Be sure to catch our latest podcast, supported by Truework this week. Truework streamlines processes by consolidating all verification methods into a single platform which benefits lenders by minimizing process interruptions, sustaining competitive borrower experience and reducing the costs associated with income verification. This episode includes an interview with Richard J. Traub from Smith, Gambrell & Russell about the commercial real estate industry and its relevance to the residential sector.

Let’s delve into Broker and Lender Services, Programs, and Software.

Continue reading

In order to sustain the growth of creativity within the industry and improve service to homeowners, it is crucial for authorities to pinpoint and confront one of the biggest hurdles to invention: monopolies.

Continue reading