“Insightful Recap: A Deep Dive into the February Mortgage Market Trends of 2024”

A Dynamic Week in the Mortgage Industry: Analyzing Key Movements

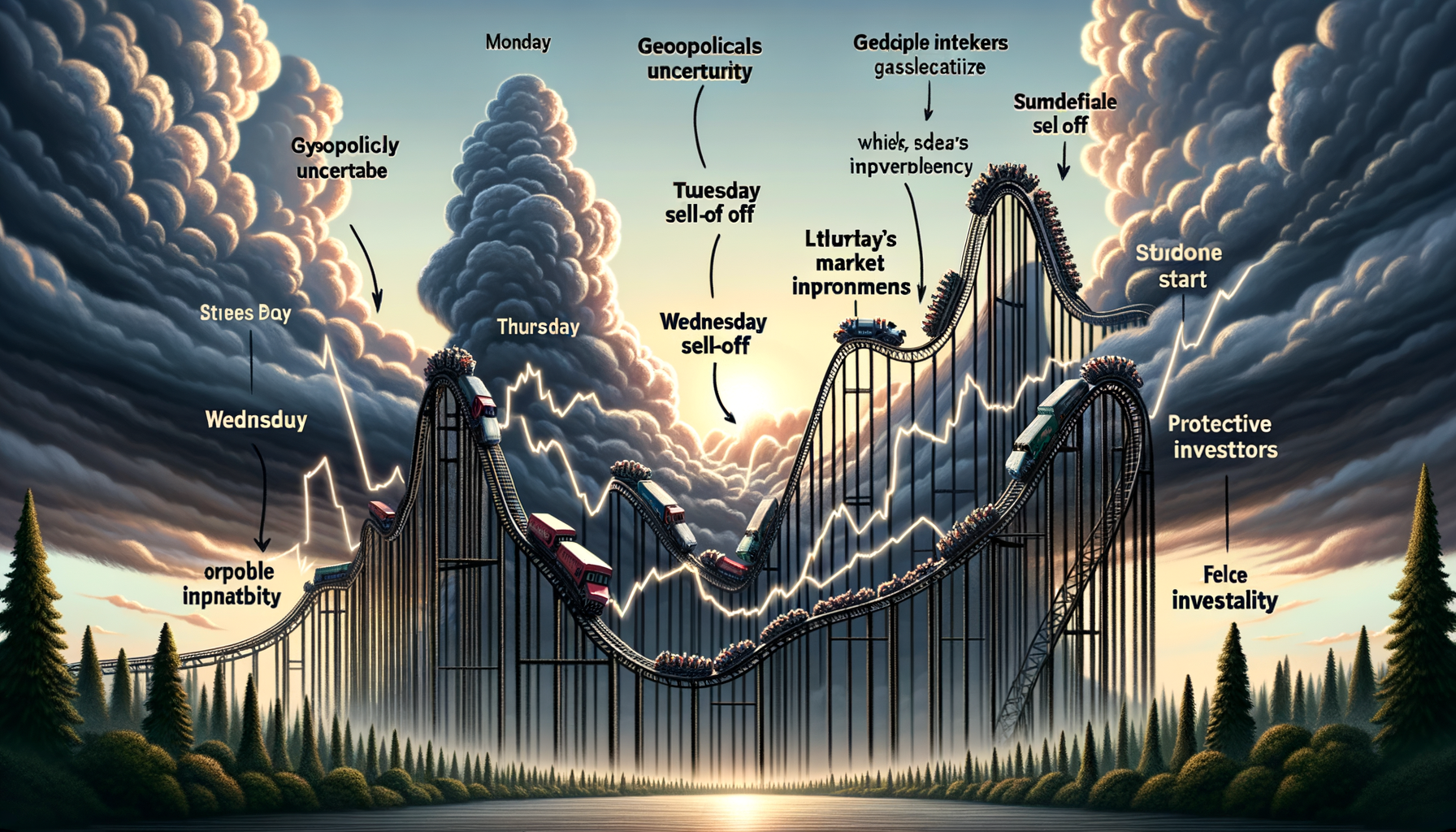

In today’s review, we delve into this week’s key happenings in the mortgage-backed securities (MBS) market. The financial week originating February 28, 2024, was one filled with market turmoil, flanked by Russia’s invasion initiation and newfound COVID-19 fears. The two events prompted significant market reactions, reflected in MBS and Treasury yield highs and lows.

At the start of the week, investors grappled with the fresh news of Russia’s invasion of Ukraine, causing market reactions intensified by COVID-19 worries. This potential for increased military activity generated unease in the market, driving investors toward the safety of bonds. Consequently, this flight to safety incident induced a reduction in bond yields, ultimately benefiting mortgage rates.

On Monday, yields were distinctly lower as investors scrambled for the protection of bonds. The geopolitical instability created by Russia’s actions and its potential to escalate military activity raised concerns globally. Furthermore, the worries were compounded by a resurgence of COVID-19 fears, making Monday a dramatic day for both MBS and yields.

Tuesday, however, brought a change of tide. The yield market witnessed a sharp sell-off, seen as a reaction to sudden improvement realization. It indicates the market was too quick to fright, leading to a much-welcomed adjustment. This indicates how markets can sometimes overreact to news, driving yields far lower than they should go. When reality doesn’t match the fear, we often see a sharp reversal, and Tuesday was a classic example of this phenomenon.

On Wednesday, the market started in an uncertain manner but continued with a sell-off taking hold as the day progressed. An absence of data and headlines left traders moving according to peculiar influences. The lack of headlines allowed markets to focus on smaller events and technicals that wouldn’t typically move the needle.

The stability witnessed on Thursday after the tumultuous early week was quite welcomed by market watchers. MBS managed to reclaim some lost ground contributing to the week’s rollercoaster ride. All this despite facing immediate geopolitical instability, indicating that the market is capable of resilience.

The MBS market experienced a dramatic ride of jumps and falls throughout the week. As such, the behavior of MBS is key towards understanding the movement in mortgage rates. When economic or geopolitical news sparks fear, investors often seek safety in the bond market. As demand for bonds increases, the yield, or interest, offered on these bonds decreases. As mortgage rates are heavily influenced by the yield on U.S. Treasury bonds, an increasing demand for bonds generally leads to lower mortgage rates.

In all of this, most would wonder why the 10-year Treasury yield is so crucial in this dynamic? This is because it is one of the chief measures mortgage lenders use to determine mortgage rates. A rise or drop in this yield has a direct influence on the mortgage rate. Depending upon the economic scenario and market forces, this yield fluctuates. As such, geopolitical instability, as seen this week, typically results in a lowering of the yields, translating to lower mortgage rates, providing some benefit in all the chaos.

The importance of MBS behavior this week is notable as well. After all, MBS prices are the primary driver of daily mortgage rate changes. Higher prices equate to lower rates (and vice versa). So, watching MBS market performance is imperative for those keen on monitoring mortgage rates. This weekly overview shows us the influence of global events on MBS, yields, and ultimately, mortgage rates.

This week was rife with examples of how economic data and geopolitical stability (or instability) impact the world of MBS and mortgage rates. Investors looking for ways to safeguard their portfolios turned to bonds, resulting in lower yields. The surprise yield sell-off also showed us that markets can sometimes overreact to alarming news, leading to shifts that may or may not always reflect the actual global situation.

And then, there’s the impact of the COVID-19 fears resurgence. The prospect of a renewed wave of infections and potential restrictions placed a strain on global markets this week. The apprehensions surrounding the virus are already incorporated into the market psychology, yet each spike or decline in case numbers creates uncertainty and potential volatility.

In conclusion, the interplay and influence of many factors such as geopolitical tensions, pandemic concerns, and economic data on MBS and mortgage rates are undeniably interconnected. These various elements continue to drive the market’s fluctuation and influence both investor sentiment and actions. However, one thing that stands tall during uncertainty is the inherent resilience of the market itself.

As we head into a new week, it is full of potential for change, as uncertainties persist. While the uncertainty of Russia’s next moves and COVID-19’s unpredictable nature remains, they form an intricate backdrop for the world of MBS, yields, and mortgage rates. Regardless of the week’s challenges, the importance of market resilience, adaptability, and investors’ clever strategies remains highlighted, crafting unique opportunities amid uncertainty.