“Exploring the Future of Mortgage Markets: A Thorough Analysis for May 2024”

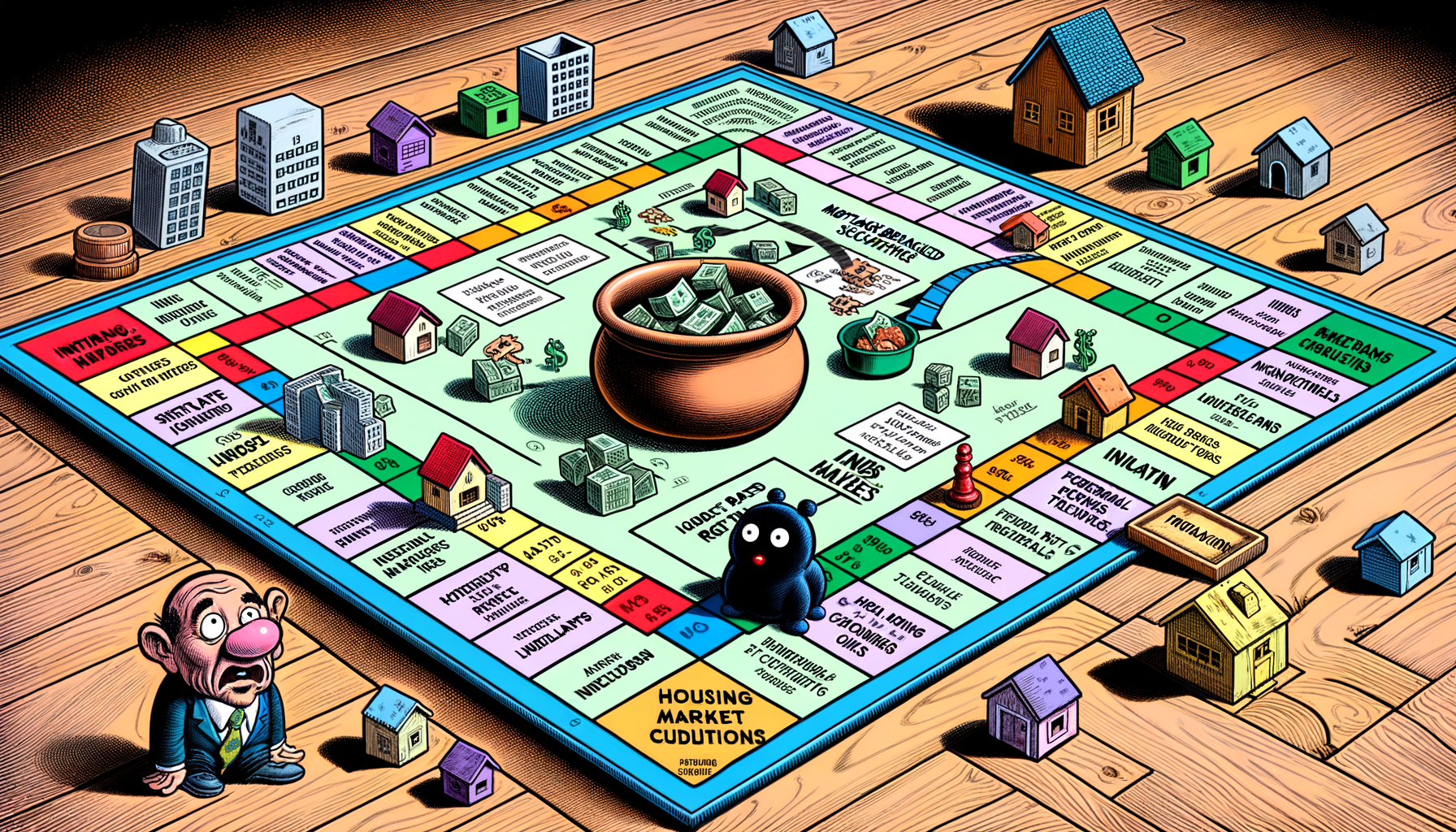

In the dynamic world of Mortgage-Backed Securities (MBS), every new day brings its own set of variations and variables that can sway investment decisions and the broader economic outlook. Understanding the movements within this market is crucial not only for investors but also for anyone involved in the housing and mortgage industries. Today, we’ll dive into the factors influencing MBS performance, providing a thorough analysis to keep you informed and prepared.

### What Exactly Are Mortgage-Backed Securities?

Before we delve into the intricacies of their market movements, let’s define what MBS actually are. Mortgage-Backed Securities are a type of asset-backed security that is secured by a mortgage or collection of mortgages. These mortgages are bought from banks and other lending institutions and then assembled into sets called pools. This is a significant aspect of the bond market, where the payment of principal and interest from the borrower is passed through to the MBS holder.

### Key Drivers of MBS Market

Understanding the catalysts that drive the MBS market is essential for navigating its complexities. These include:

– **Interest Rates**: The most prominent factor that affects MBS is changes in interest rates. MBS, like bonds, typically inversely react to interest rate fluctuations. When rates rise, MBS prices tend to fall, and vice versa.

– **Economic Indicators**: Strong economic indicators such as a low unemployment rate or significant GDP growth can increase the likelihood that the Federal Reserve will raise interest rates to curb inflation, which would typically lower MBS prices.

– **Federal Reserve Policies**: The Fed’s approach to monetary policy, especially decisions regarding interest rates and asset purchases (including MBS), can have substantial impacts on MBS valuations.

– **Housing Market Conditions**: Since MBS are backed by mortgage loans, the state of the housing market can affect their value. Factors like home sales, the supply of homes, and default rates can all play a role.

### Today’s Market Review

On this particular day, the MBS market experienced subtle yet noteworthy shifts. Observers and analysts noted a slight decline in MBS prices, attributed primarily to the market’s anticipation of future interest rate hikes. Such expectations stem from recent economic reports suggesting an uptrend in inflation, which although beneficial in battling economic stagnation, typically prompts a rise in interest rates.

### Interest Rate Expectations

The discussion about interest rates is never far from the table when talking about MBS. Today’s market sentiment has been heavily influenced by the probability that the Federal Reserve may adjust rates upward in the near future. This speculation is backed by recent inflation data that exceeded expectations, signaling a potentially overheating economy that the Fed may seek to cool down by making borrowing more expensive.

### Impact of Inflation

Inflation is a two-edged sword in the economy; moderate levels are signs of a healthy economy, while too high or too low can cause significant issues. The current inflation metrics indicate a tendency towards the higher end of the spectrum, thereby affecting consumer purchasing power and spending behaviors, which indirectly influences the mortgage market. Rising inflation often causes fixed-income assets like MBS to lose appeal since the real return on these investments could diminish.

### Housing Market Trends

Turning to the housing sector, recent data shows robust activity with an increase in home sales and prices, fueled by low mortgage rates and a tight housing inventory. While good news for the real estate sector, these trends impact the MBS market by influencing prepayment rates on existing mortgages. Homeowners are incentivized to refinance their mortgages under such conditions, which can lead to early returns of principal to MBS investors, affecting the yield on their investments.

### Technological Advancements in Mortgage Processing

An often overlooked aspect that indirectly affects the MBS market is the technological advancement in mortgage processing and underwriting. Fintech innovations make mortgages more accessible and streamline the application and approval processes, resulting in more efficient market dynamics and potentially increased volumes of mortgage originations.

### The Outlook: What Lies Ahead

Looking forward, the MBS market remains a complex arena influenced by various economic, political, and sector-specific factors. Investors are advised to keep a keen eye on Federal Reserve announcements, economic data releases, and housing market trends.

### Investment Strategies in Current Market Conditions

In such a landscape, MBS investors might consider several strategies:

– **Diversification**: As always, diversifying holdings can help manage risks associated with volatility in the MBS market.

– **Stay Informed**: Keeping abreast of economic indicators and central bank signals can provide crucial insights into potential market movements.

– **Consider Duration**: In a rising interest rate environment, shorter-duration MBS may be less sensitive to interest rate changes than longer-duration securities.

### Conclusion

The day’s market movements in the MBS sector reflect the intricate dance between economic indicators, Federal policies, and market sentiment. While the slight decline in MBS prices might concern some, it is essential to view these changes within the broader context of economic cycles and market dynamics. As we watch how these elements unfold, staying informed and strategically agile will be key to navigating the future terrain of the mortgage-backed securities market.