“Exploring the Future of Green Housing and Real Estate Transformations: A Comprehensive Insight”

In the ever-evolving landscape of the U.S. housing market, challenges related to affordability continue to dominate discussions among industry experts, policymakers, and potential homebuyers. As prices fluctuate and demographic shifts take hold, the question of how to keep homes affordable for average Americans becomes increasingly critical. Understanding the multifacetal dilemmas surrounding homebuying affordability is key to navigating future trends and identifying viable solutions.

### Historical Context and Current Trends

Historically, housing prices in the United States have witnessed cyclical patterns, marked by periods of rapid growth and subsequent corrections. However, the decades surrounding the turn of the millennium saw unprecedented price growth due to a combination of factors including low interest rates, liberal lending practices, and speculative buying, which culminated in the 2008 financial crisis. Post-crisis recovery was uneven, with some areas seeing prices stagnate while others, particularly urban centers and tech hubs, experienced significant surges.

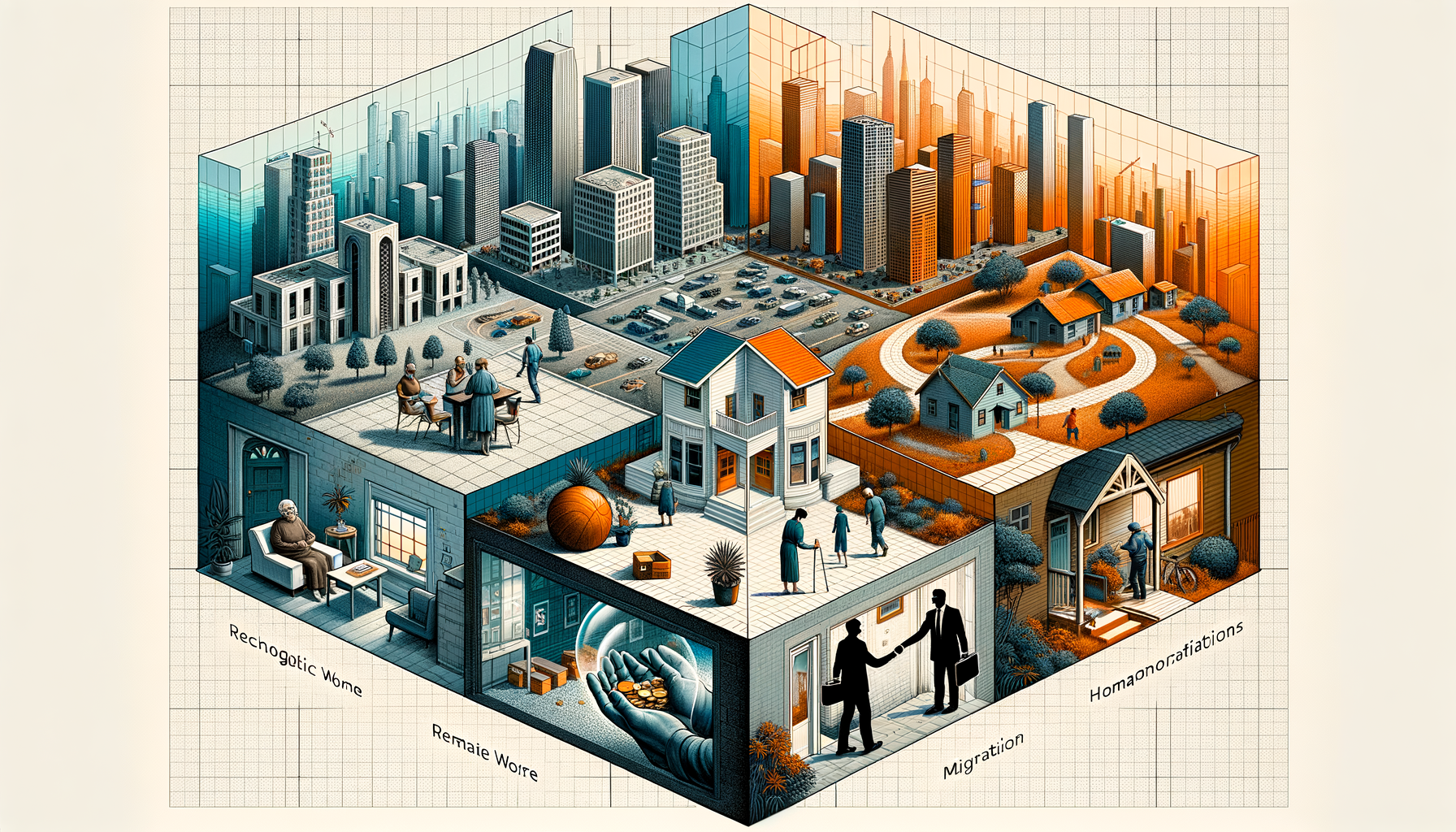

The recent pandemic further complicated these trends by triggering a shift in homebuyer preferences. With remote work becoming more feasible and, in some cases, permanent, a significant portion of the workforce is opting for larger homes in less densely populated areas, thereby inflating prices in regions previously known for their affordability. This migration pattern, though beneficial for some remote and rural locations, has squeezed local housing markets and pushed prices upward, affecting overall affordability.

### Demographic Shifts Impacting Homeownership

Shifts in demographics also play a pivotal role in shaping housing demands and affordability. As baby boomers age, their housing needs alter, often inciting discussions around downsizing or moving closer to essential services, thereby influencing the market for smaller homes and accessible living. Concurrently, millennials and Gen Z are entering the market with different expectations, priorities, and financial burdens compared to previous generations. Saddled with higher levels of student debt and entering the workforce during or in the aftermath of recessions, these younger generations face unique challenges in achieving homeownership.

### Technological Innovations and Their Effects

Technology continues to reshape the real estate landscape in multifaceted ways. From virtual home tours and online mortgage applications to AI-driven market analysis and blockchain for secure transactions, technological advancements are making it easier for consumers to access real estate services and streamline the home buying process. However, while these innovations enhance user experience and can reduce costs, they also necessitate a balance with personal touch and expertise often required in real estate transactions.

### Governmental Policies and Interventions

Government policy has arguably the most significant leverage in addressing housing affordability. Measures can range from adjusting lending regulations, as seen with the tightening of credit post-2008, to subsidizing affordable housing projects or offering tax incentives for first-time homebuyers. Local governments often face the challenge of zoning laws which can restrict supply and inflate property costs, creating pockets of high-priced housing alongside areas of declining market value.

Federal initiatives, such as changes to the tax code or funding allocations for urban development, also possess the potential to broadly influence housing affordability. For instance, increasing the supply of low-income housing tax credits can incentivize developers to contribute to the affordable housing inventory, helping to stabilize or even reduce home prices in heavily impacted areas.

### Practical Solutions and Forward-Looking Strategies

Given these wide-ranging factors affecting the housing market, several strategies can be employed to foster and retain affordability:

1. **Build More Affordable Housing:** Direct construction of affordable housing units remains one of the most straightforward solutions to meet the demand of low- to middle-income buyers. This approach often requires collaboration between public entities and private developers, balanced with incentives such as tax breaks or expedited permitting processes.

2. **Preserve Existing Affordable Housing:** Equally important is the preservation of aging affordable housing, which involves rehabilitating structures to extend their usable life and prevent them from descending into disrepair or being replaced by more expensive developments.

3. **Implement Rent Controls:** For metropolitan areas experiencing rapid price increases, rent control policies can provide temporary relief by capping the amount landlords can charge for rentals, potentially slowing down the rate at which rent escalates and maintaining a stock of affordable rental units for lower-income residents.

4. **Innovate in Financing:** Financial innovation can also help bridge the gap between rising home costs and buyer affordability. Programs like shared equity models, where a portion of the home equity is shared with investors or governments, can assist buyers who can afford monthly payments but struggle with large down payments.

5. **Educational Outreaches and Counseling:** First-time homebuyer programs and housing counseling are invaluable resources that potential buyers should leverage to understand their options especially concerning government-sponsored loans or grants that can facilitate easier entry into the homeownership.

### Conclusion

The trajectory of housing affordability will significantly hinge on how well all stakeholders – governments, businesses, communities, and individuals – respond to the ongoing and evolving challenges. A multi-front approach that includes policy reform, community engagement, technological advancement, and innovative financial tools will be essential in making housing both accessible and affordable for future generations in the United States. As we look forward, continuous dialogue and willingness to adapt will serve as critical components in shaping a sustainable housing market where all potential homebuyers can find a place to call home.