“Unraveling the Trends: A Deep Dive into the 2024 Mortgage Market Updates”

In recent times, the financial sector has been witnessing a relentless disruption, mainly due to the unpredictable dynamics of mortgage rates. The mortgage market is not a stranger to the winds of change, with rates fluctuating day by day.

The mortgage market is enormously complex. Fundamentally, the mortgage rate is the interest percentage that you pay on the outstanding balance of your mortgage. Over the span of months or years, even slight variations in the rate can make a significant difference in the overall cost.

Lately, there’s been a considerable rate increase which has captured ample attention in the financial community. Mortgage professionals and potential homeowners alike are scrambling to understand the parabola of change in mortgage rates. While some directionally predicted an increase in rates, the speed and level of the ascent have caught many by surprise.

For an extensive period, the climb of mortgage rates was steady and predictable yet, in recent times, there’s been an abrupt surge that has left the industry rather bewildered. It’s important to highlight that this sudden rise also concludes several months of historically low mortgage rates. This dramatic shift has led to a substantial amount of concern and speculation among homeowners and potential buyers.

Let’s delve into the details of the rate changes. Previously, the average mortgage rate wobbled around the 3% mark; however, recently, this figure has inflated significantly. One of the main reasons for this escalation is due to rampant inflation, which has instilled anxiety in the mortgage market.

One crucial factor that often gets overlooked is the bond market. The bond market plays a pivotal role in deciding the trajectory of mortgage rates. Investors use the 10-year U.S. Treasury as a benchmark for longer-term interest rates like mortgages. Usually, mortgage rates are directly proportional to Treasury yields – when Treasury yields rise, mortgage rates are likely to follow suit – and that’s exactly what’s happening now.

Mortgage holders are being forced to levy higher interest rates due to increasing treasury yields, which are being catapulted by rampant inflation. Inflation weakens the value of future cash flows that investors will receive from bonds, compounding the steep hike in rates. Consequently, when inflation is on the rise, it’s common for investors to sell their lower yielding bonds, leading to higher bond yields and, consequently, higher mortgage rates.

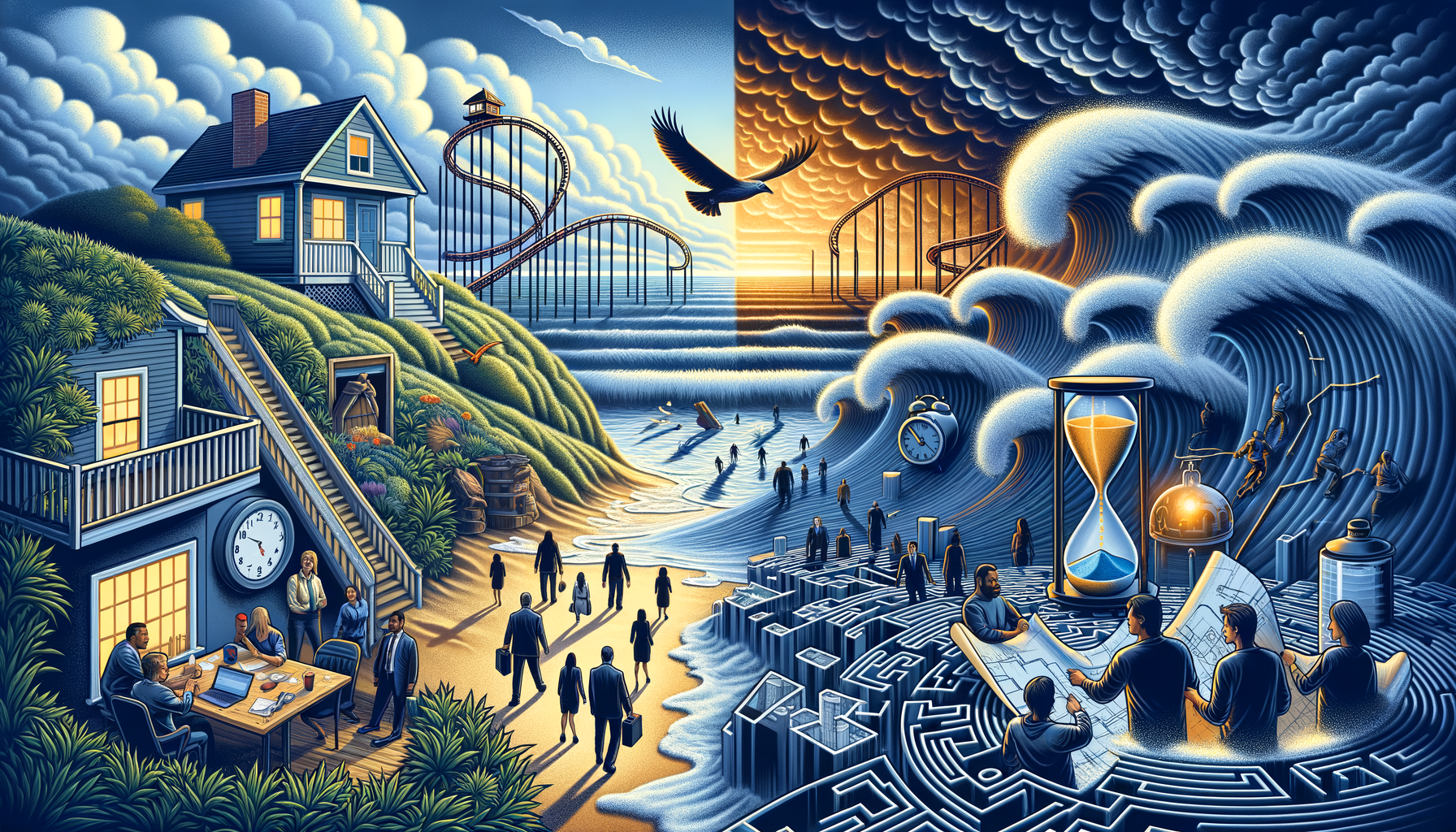

From market fluctuations to global events, these economic variables can instigate volatile changes in mortgage rates, often within a matter of few days. The same way a soothing wind can quickly turn into a tempest, a series of minor adjustments in the global market can unleash a storm in mortgage rates.

For would-be homeowners, the consequences of this sharp increase reflect in the higher monthly repayments. Significant rate variations affect how much mortgage consumers must pay back every month, increasing the total cost of their house purchase. Simply put, the higher the mortgage rate, the larger the total repayment over the duration of the mortgage.

This upward traction in rates is a sobering reality for some buyers who were hoping to lock in lower interest rates, but now, they must face the music of a rate environment nose-diving towards unanticipated highs. Nevertheless, it’s key to remember that this surge in rates is still lower relative to historical standards.

Although increasing mortgage rates are cause for concern for potential homeowners, expert opinion suggests patience. As the market calibrates and returns to a period of stability, there may be a chance for more favorable conditions. Akin to a roller coaster ride, what goes up must inevitably come down. These highs are usually trigged by short-term volatility in the market, and chances are the descent is just around the corner.

Mortgage rate shock has ruffled the feathers of many market participants. It would be beneficial for industry experts and observers alike to remember that the mortgage market’s existence is characterized by cycles of ups and downs. Instead of panicking, one can strive to adapt to these varying rates.

While it is almost impossible to foresee the exact direction of mortgage rates in the coming weeks, one thing is certain: mortgage rates will continue to ebb and flow with the tides of the global economy. Amidst the turbulence, a well-informed cope-up strategy could save buyers when the tide is high.

Ultimately, whether you’re a professional in the industry or a potential homeowner looking to enter the market, understanding these dynamics is crucial to navigate the complexity of the mortgage landscape. Knowledge is, after all, power; power that can potentially save thousands of dollars and make the path towards homeownership smoother and less fraught. Despite these factors seeming overwhelming, keeping our heads held high in the face of this uncertainty can help us all weather this financial storm.